Innovation is Our Business

The best partner for Corner Shops

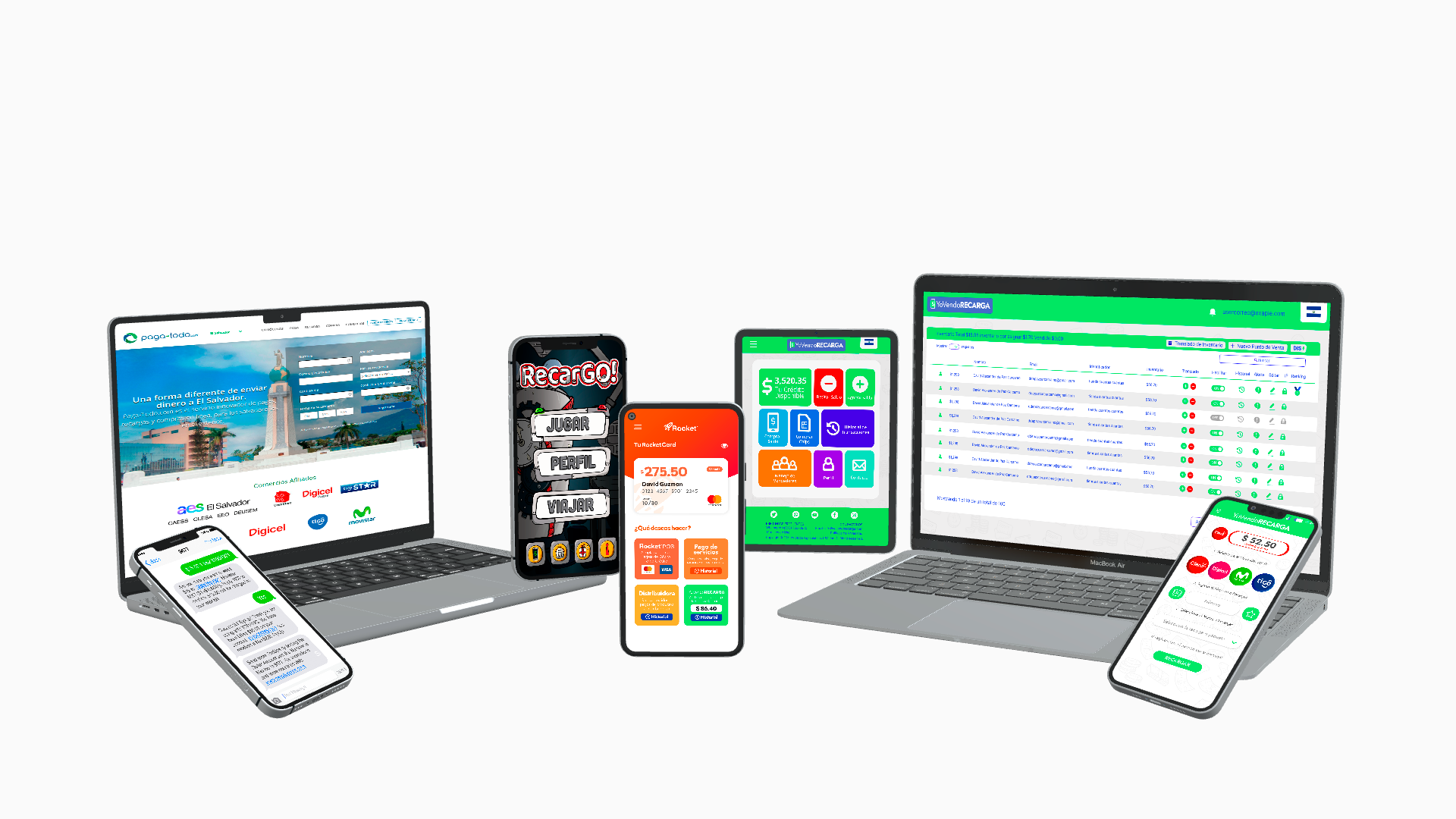

We are solving the traditional Air Time TopUp distribution problems for Mobile Operators in Latin America and under developed countries using Seller & Buyer App.

The first & only App for selling domestic top-ups.

Free for users and MNOs.

Income generator for users.

One App for all mobile operators.

Eliminate commute to retail stores.

iOS & Android.

Eliminates cost of distribution for MNOs.

Our Partners

API Envío de recargas

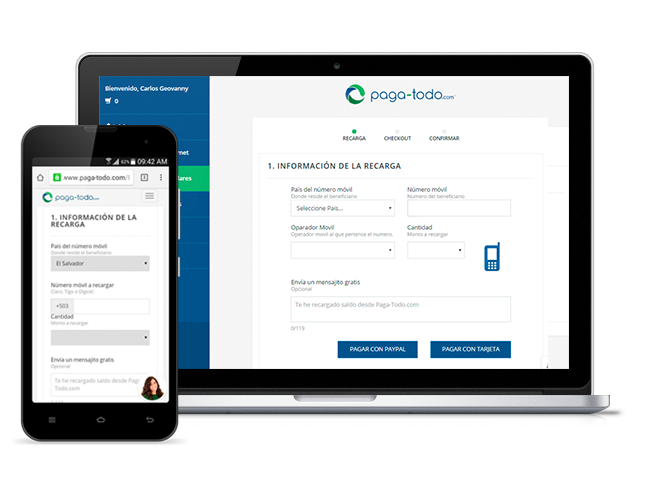

We are the first website where you can pay your bills and pay for your relative’s bills, top up your phone as well as family's phones, buy gift certificates and send donations, buy handsets and more, everything in the same place.

Payments from anywhere in the world.

Available 7/24/365.

Customer Service Innovation for your company.

Perfect tool for reducing late payments.

Transactions supported by PayPal, MasterCard & Visa.

Our Partners

"Paga-Todo.com is providing an innovative solution for relatives or friends who are out of El Salvador to support their loved ones in an effective manner so PayPal is pleased to be one of the payment platforms."

JOSÉ FERNÁNDEZ DA PONTE

Senior Director of International e-Commerce for Paypal Latin America

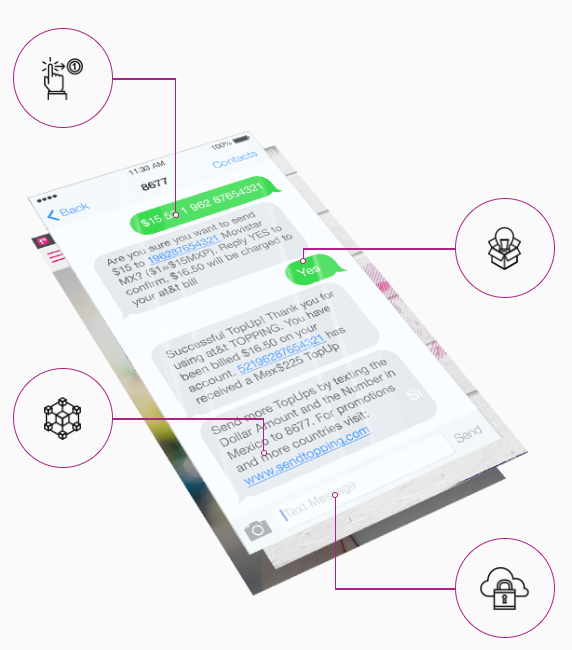

Topping is the first SMS mobile to mobile cross border International Top Up service.

CONFIDENCE BUILDING

By setting the amounts to $1, $3 and $5 it allows us to gain confidence from the customers in favor of our system. It encourages the users to try the service.

FEWER CLAIMS

It is less probable that a user will open a claim against the operator because of the low amounts, thus, having lower amounts is beneficial for the duration of the project.

PROMOTES FREQUENT TOP-UPS TO MULTIPLE RECIPIENTS

We also believe that by having lower amounts, the users will be predisposed to send air-time, and thus send Air Time to several relatives and not only one.

AML RISK MITIGATION

We know that by limiting funding amounts, Money Laundry Risk can significantly be mitigated.

Recar-GO! is the first Augmented Reality Game for Mobile Network Operators, designed to increase sales, loyalty and acquisition of new customers

Its attraction and viral potential has been proven worldwide thanks to other games that use this technology. Recar-GO! allows its users to win real prizes in real time and with immediate delivery to their phones, giving them enormous satisfaction due to the instant gratification.

EASY REGISTRATION

You only need to verify your phone number.

YOUR MAP, YOUR GUIDE

The map will show your location.

REQUEST TOP UPS

You can send a Top Up request to sellers of YoVendoRecarga.com

AUGMENTED REALITY

Discover prizes nationwide

TRADITIONAL POINTS OF SALE

You can locate traditional points of sale (pharmacies, stores, etc.)

SHOWS YOU SELLERS OF YOVENDORECARGA.COM

You can find a seller of YoVendoRecarga near you.

GlobalPay Air Time Switch

The GATS® is the center core of the operations.

PROCESSING

BALANCES

23 NYCRR Part 500 | CCPA | CDSA CFTC 1.31 | FDA CFR Title 21 Part 11 FERPA|FFIEC|GLBA|GxP| HIPAA/HITECH | HITRUST | MARS-E MPAA | NERC | SEC 17 a-4 | SEC Regulation SCI | Shared assessments SOX | TruSight

TRACKING

INTEGRATIONS

Recent News

GlobalPay Solutions at Mastercard Innovation Forum 2023

July 05th 2024

July 05th 2024

Innovative Payment Solutions for MSMEs: Rocket's Vision Unveiled at Mastercard Innovation Forum 2023

GlobalPay Solutions recently participated in the Mastercard Innovation Forum 2023, sharing Rocketâs vision on the panel âPartnering for Payment Acceptance in Micro and Small Businesses.â The event was filled with productive discussions and valuable learning experiences, highlighting the potential for innovative solutions like Rocket to transform payment acceptance for MSMEs. The enthusiasm and insights gathered promise a dynamic 2024, aiming to surpass the achievements of 2023.

Rocket is aiding micro and small businesses by providing a comprehensive digital payment ecosystem. Our platform offers e-wallets, POS systems, mobile top-ups, bill payments, and micro-loans. These tools enable MSMEs to accept digital payments seamlessly, enhance their operational efficiency, and access affordable credit. By digitizing transactions and expanding financial services, Rocket empowers underserved segments, including women, youth, and rural communities, contributing to financial inclusion and economic growth.

Stay tuned for more updates as we continue to drive financial inclusion and innovation in the fintech space!

#Innovation #PaymentAcceptance #RocketPOS

GlobalPay Solutions en el Mastercard Innovation Forum 2023

GlobalPay Solutions participó recientemente en el Mastercard Innovation Forum 2023, compartiendo la visión de Rocket en el panel âPartnering for Payment Acceptance in Micro and Small Businesses.â El evento estuvo lleno de discusiones productivas y experiencias de aprendizaje valiosas, destacando el potencial de soluciones innovadoras como Rocket para transformar la aceptación de pagos en las MIPYMES. El entusiasmo y las ideas recogidas prometen un 2024 dinámico, superando los logros de 2023.

Rocket está ayudando a los micro y pequeños negocios proporcionando un ecosistema de pago digital integral. Nuestra plataforma ofrece billeteras electrónicas, sistemas de punto de venta (POS), recargas móviles, pagos de facturas y microcréditos. Estas herramientas permiten a las MIPYMES aceptar pagos digitales de manera fluida, mejorar su eficiencia operativa y acceder a crédito asequible. Al digitalizar las transacciones y expandir los servicios financieros, Rocket empodera a los segmentos desatendidos, incluidas mujeres, jóvenes y comunidades rurales, contribuyendo a la inclusión financiera y el crecimiento económico.

¡Manténganse atentos para más actualizaciones mientras continuamos impulsando la inclusión financiera y la innovación en el espacio fintech!

#Innovación #AceptacióndePagos #RocketPOS

[gallery ids="1559,1560,1558,1557"]

GlobalPay Solutions at MasterCard Fintech After Office

July 05th 2024

July 05th 2024

GlobalPay Solutions Highlights Collaborative Opportunities at MasterCard Fintech After Office

On Tuesday, July 25, 2023, GlobalPay Solutions had the honor of participating in the first edition of âMasterCard Fintech After Officeâ In Sal Salvador. This event focused on discussing opportunities for collaboration between Fintech companies and various stakeholders, such as banks, in El Salvador. The economic potential of these partnerships was a key topic.

Invited by MasterCard as a speaker, GlobalPay Solutions discussed how banks can leverage digital platforms like Rocket to reach potential clients more efficiently. The discussion covered the integration of Fintech tools into traditional banking systems to enhance financial inclusion and drive economic growth.

Key Discussion Points:

- Collaboration Potential: Exploring the synergies between Fintech and banks to unlock new economic opportunities.

- Digital Tools:How banks can utilize platforms like Rocket for better customer reach and service efficiency.

- Economic Growth: The impact of these collaborations on the broader economic landscape of El Salvador.

The evening was filled with insightful discussions and networking opportunities, aimed at driving innovation and collaboration in the financial sector.

#Fintech #FinancialInclusion #RocketPOS #MasterCard #ElSalvador #Innovation

GlobalPay Solutions en el MasterCard Fintech After Office

El martes 25 de julio de 2023, GlobalPay Solutions tuvo el honor de participar en el primer evento de âMasterCard Fintech After Officeâ en San Salvador. Este evento se enfocó en discutir las oportunidades de colaboración entre las empresas Fintech y diversos actores, como los bancos, en El Salvador. El potencial económico de estas asociaciones fue un tema clave.

Invitados por MasterCard como ponentes, GlobalPay Solutions discutió cómo los bancos pueden aprovechar plataformas digitales como Rocket para llegar a los clientes potenciales de manera más eficiente. La discusión abarcó la integración de herramientas Fintech en los sistemas bancarios tradicionales para mejorar la inclusión financiera y fomentar el crecimiento económico.

Puntos Clave de la Discusión:

- Potencial de Colaboración: Explorar las sinergias entre Fintech y bancos para desbloquear nuevas oportunidades económica Herramientas

- Digitales:Cómo los bancos pueden utilizar plataformas como Rocket para mejorar el alcance y la eficiencia del servicio al cliente.

- Crecimiento Económico: El impacto de estas colaboraciones en el panorama económico más amplio de El Salvador.

La noche estuvo llena de discusiones perspicaces y oportunidades de networking, destinadas a impulsar la innovación y la colaboración en el sector financiero.

#Fintech #InclusiónFinanciera #RocketPOS #MasterCard #ElSalvador #Innovación

[gallery ids="1531,1530,834,832,833"]

Mastercard lanza nuevo programa de inclusión financiera para millones en Guatemala, El Salvador y Honduras

October 17th 2022

October 17th 2022

Mastercard anunció el lanzamiento de un nuevo programa de inclusión financiera en Guatemala, El Salvador y Honduras que acelerará el objetivo de la compañÃa de incluir a cinco millones de personas no bancarizadas y digitalizar y otorgar acceso a crédito a un millón de micro y pequeñas empresas (MIPYMES) en los 3 paÃses en el transcurso de cinco años.

En el año 2022, GlobalPay Solutions, en asociación con Mastercard y Microsoft, lanzó la aplicación ROCKET para empoderar a los pequeños comerciantes de El Salvador. ROCKET es una aplicación móvil para tiendas que permite a los comerciantes habilitar la aceptación de tarjetas para compra de bienes y servicios, pago de servicios públicos, recargas de teléfonos móviles y más.

Para seguir leyendo da clic en el siguiente enlace: https://news.microsoft.com/es-xl/rocket-pos-la-app-que-impulsa-pequenas-tiendas-hacia-la-digitalizacion-de-sus-negocios/

Contact us:

United States

Paga-Todo.com

YoVendoRecarga.com

Rocket